BLS data show 64,000 job rebound in November after October drop

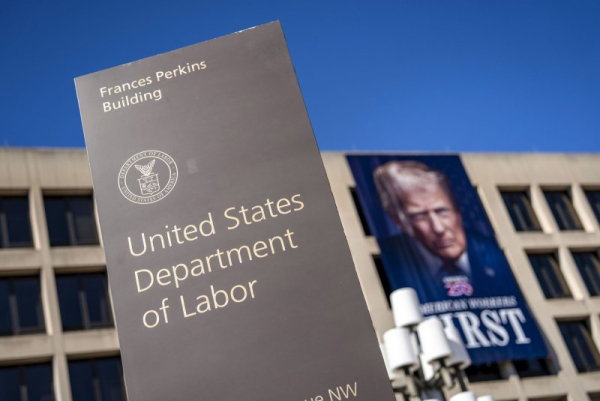

The U.S. Department of Labor Headquarters pictured in August in Washington, D.C. The labor market remained sluggish marked by limited hiring and minimal layoffs further strained by U.S. President Donald Trump’s tariff and border policies that have reduced the flow of immigrant workers. File Photo by Bonnie Cash/UPI | License Photo

The Bureau of Labor Statistics said Tuesday that nonfarm payroll jobs for November jumped a little more than projections.

For the month, Wall Street projected some 45,000 jobs but came in at 64,000 total in delayed BLS numbers due to the government shutdown.

Unemployment climbed to 4.6%, which surpassed forecasts and marked the highest point since September 2021.

The labor market remained sluggish marked by limited hiring and minimal layoffs further strained by U.S. President Donald Trump’s strict tariff and border policies that have reduced the flow of immigrant workers, according to new data by the U.S. Department of Labor.

“The Fed is unlikely to put much weight on today’s report given data disruptions,” Kay Haigh, global co-head of fixed income and liquidity solutions at Goldman Sachs, told CNBC.

Meanwhile, the broader jobless measure, which counts discouraged workers and involuntary part-timers, rose to 8.7% in its highest level in more than four years.

Federal officials have argued that inflation is not driven by the labor market, and that Tuesday’s jobs data reinforced the assertion.

Alongside the November data, the BLS issued revised October figures showing payrolls falling by 105,000.

Many Wall Street analysts anticipated a drop after September’s unexpected 108,000 gain.

Public payrolls fell by 162,000 in October and slipped another 6,000 in November. October’s drop marked the third payroll decline in six months.

The BLS also revised earlier figures, cutting August’s total by 22,000 to a deeper loss of 26,000 and trimming September’s numbers by another 11,000.

Data collection issues in October forced the cancellation of both the jobs report and the closely monitored consumer price index.

November’s job growth was driven largely by familiar sectors.

Health care led with 46,000 new positions at over 70% of the total gain while construction added 28,000 and 18,000 in social assistance.

Transportation and warehousing shed 18,000 jobs, extending the sector’s ongoing decline. Leisure and hospitality followed with a loss of 12,000 positions.

The U.S. Federal Reserve recently marked its third straight cut since September, bringing the target range to 3.5%-3.75% but indicated that further cuts are unlikely soon.

Average hourly wages edged up only 0.1% in the month, missing the 0.3% forecast, and climbed 3.5% year over year in the slowest growth since May 2021.

Over the two-month period, household employment actually increased by 407,000. But that was offset partially by a rise of 323,000 in the labor force as the participation rate edged higher to a little more than 62%.

“The report on December’s employment data, released in early January ahead of the next meeting, will likely be a much more meaningful indicator for the Fed when it comes to deciding the near-term policy trajectory,” Haigh said Tuesday.